Why Solar Now? It's a Guaranteed Investment!

Why Solar Now? It’s a Guaranteed Investment! That’s a bold statement that I would not say if it weren’t for one fact; It’s true. Home solar has reached the most critical plateau for accelerated growth in 2020. The biggest reason is that you would have to overpay for home solar and do long-term financing to lose money. Now that it’s almost impossible to lose money going solar, leads us to the next question, how much can I make from having solar?

Solar Is An Investment

Solar is now a very sound investment so long as you avoid two pitfalls, overpaying and long-term financing. I provide examples below that show you the cost of electricity for 25 years, including price increases. In the following example, I use $150 a month cost of electricity, but the sample is scalable. The bottom line is you can buy a solar system today for as little as $17,000 that will produce $49,000 in power over 25 years. That’s a fantastic profit of $32,000 over that period.

Many people think that’s not very much savings over 25 years, but you will be out every dime of that money sticking with the power company. In essence, it’s a free investment so long as you avoid the pitfalls.

Researching home solar online is difficult because the majority of the information provided comes from solar companies. They send you through a sales funnel to get any questions answered.

Far too many make ridiculous claims of savings. It’s much better to do the math and be prepared.

Below Is An Example of The True Cost of Power Over a 25 Year Period Including Increases

When calculating the value of your solar production over a twenty-five-year period, use your present-day average monthly bill and multiply x 12 Months x 25 Years and add 10% more, and that’s a realistic price increase over twenty-five years. The reasoning is that over the next twenty-five years, how we obtain our energy will diversify. So fossil fuels will probably go down in cost quite dramatically or, at minimum, hold steady, and that’s what dictates power price increases. I’m sure power companies will figure out a way to justify a higher price, but it doesn’t mean they’ll be effective at doing so.

|

Average Monthly Power Bill |

x 12 Months |

25 Years X 1800 |

10% Total Increase Over 25 Years |

Total 25 Year Power Cost Estimate |

Average Power Costs Monthly for 25 Years |

|

$150 A Month |

$1800 A Year |

$45,000 |

$4,500 |

$49,500 |

$165 A Month Average Power Costs |

A Realistic View of The Potential Savings

The reality is if your average power bill now is $150 a month, it will average about $165 a month over the next 25 years (300 Months) when calculating electricity price increases. So we know the accumulative value of your power costs $49,500. That’s what you pay the power company in twenty-five years. So now we have established the cost of electricity for twenty-five years, let us compare the price of a solar system that produces that power.

Knowing the cost of the power will show the real value of home solar and if it’s for you.

We now know you have $49,500 to invest in solar with no cost to you because you will pay the $49,500 to the power company without solar based on a $150 per month power bill.

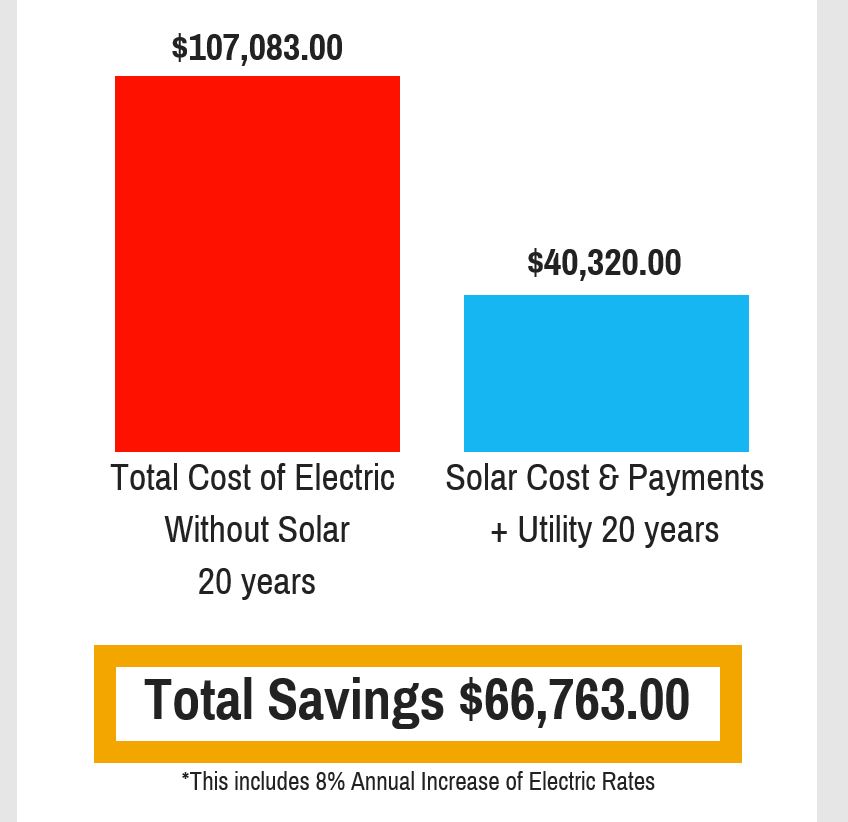

Here's A real Example of a Sales Presentation From A Solar Company. It Claims $66,000 in savings for a system slightly larger than the above example Which Is Impossible!

Try to imagine a sales rep presenting this information to a homeowner; it shoots the sales rep’s credibility out the window. Instead, I recommend avoiding long-term financing and sales funnels with too many hands in the pot. You can avoid these pitfalls by using “Your Solar Advocate“. It’s a free service that has direct connections with the installation companies, removing the sales funnels.

You Don't Need To Be A Solar Expert - Just Common Sense

Be aware of the any solar companies primary objective and that’s to make as much profit as possible. So here’s the most important things to know before purchasing home solar. Why Solar Now? It’s a Guaranteed Investment and no expertise required.

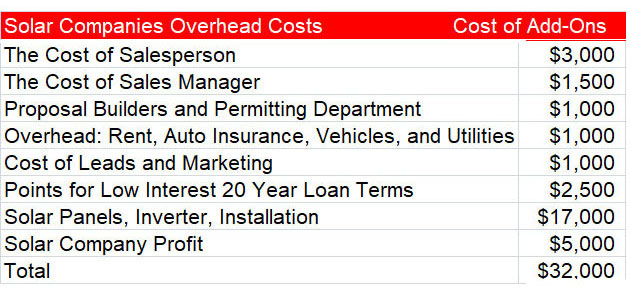

Home Solar Costs of a Typical Solar Company

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of Salesperson | $3000 |

| Sales Manager | $1500 |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | $1000 |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) | $2500 |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | $5000 |

| Total | $32,000 |

Federal ITC Is 26% Off The Above Cost for Qualified Buyers

(Many Solar Companies Use Tax Credit as a down-payment 12 to 15 months after the deal is closed)

The reason why solar companies are structured this way is that the solar company doesn’t pay those additional costs, the buyer does.

The solar company doesn’t lay out any of the costs until the finance company funds their account. This is the reason companies can’t break-away from the above business model.

Federal ITC Is 26% Off The Above Cost for Qualified Buyers

(Many Solar Companies Use Tax Credit as a down-payment 12 to 15 months after the deal is closed)

The reason why solar companies are structured this way is that the solar company doesn’t pay those additional costs, the buyer does.

The solar company doesn’t lay out any of the costs until the finance company funds their account. This is the reason companies can’t break-away from the above business model.

As you can see there are quite a few overhead costs that you can avoid. Start with $2,500 in closing points, the cost of marketing, and the cost of sales reps all can be avoided. I know if I was going to deal with any retail solar company I would contact the owner directly and cut out as much of these costs as possible.

Avoid Hard Credit Pulls and Long Term Financing

Banks don’t do home solar loans because it’s an unsecured loan and they can’t repossess home solar systems. Because banks don’t do home solar loans, the vacuum has been filled by specialty lending. Home solar lending companies provide a low interest (5%) loan for twenty years, including closing costs that average $2500, which many companies do their best to conceal. It sounds great until you discover at the closing of your deal that a 5% loan will double the cost of your solar system over a twenty-year period! In addition, there’s the $2,500 in closing points that the customer pays for it, although they are hidden from the customer.

The best way to go solar is to pay it off ASAP. When you get a proposal from any company, tell them you are paying cash to avoid these additional charges and save money. Even if your financing for a shorter term and paying it off quickly, it’s still the same as cash to the company.

Although solar buyers, for the most part, have excellent credit, you want to avoid credit pulls because they will ding your credit score. Knowing upfront, you want to avoid those closing points, there is no point in letting them run your credit. Why Solar Now? It’s a Guaranteed Investment, is true, but home solar can be an even better investment if you avoid overpaying.

Hard Times Can Strike Anybody At Any Time

No solar company is going to tell you what I’m about to tell you because it would violate there finance company policies. When you don’t pay your power bill your power gets turned off but not so with financed solar. Solar companies have no right to access your property to repossess solar panels nor do they want to.

Reality is should hard times hit and they do hit you are not under the pressure of having your power turned off. Yes it could do damage to your credit but you can right that ship at a latter date but have power in the meantime.

The only home solar loans that I’m aware of that can lien your property are government-funded PACE loans which I recommend avoiding. The problem with PACE loans is a lot of people that qualify don’t have the income to pay it off quickly. They end up overpaying for their system because of the long term interest. Why Solar Now It’s a Guaranteed Investment!

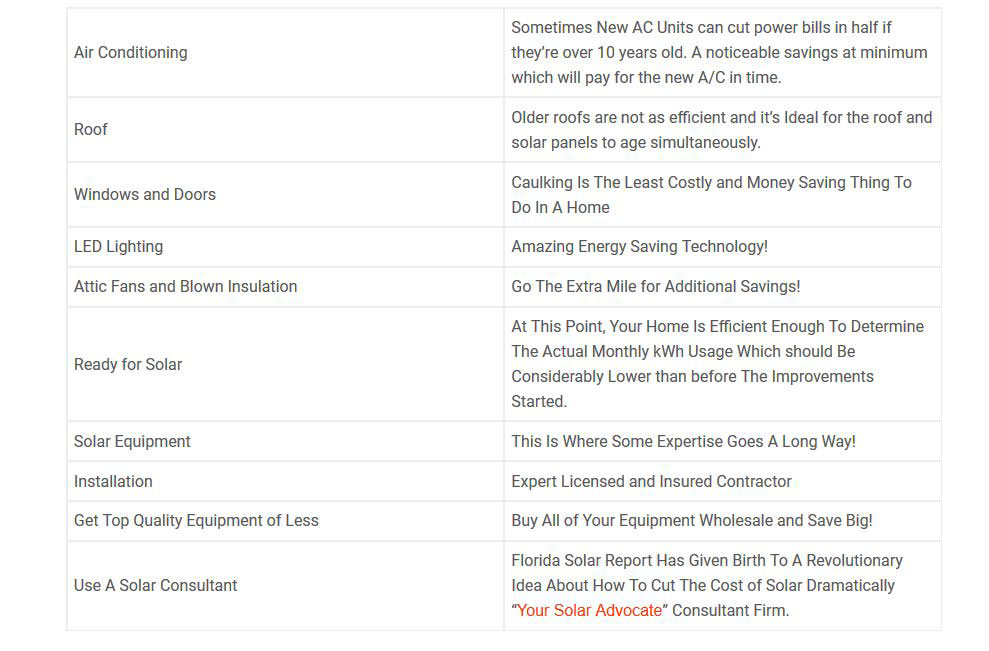

Additional Savings When You Prepare Ahead for Solar

Being prepared for home solar improves return on investment dramatically. The reason is the more efficient a home is the smaller solar system required.

The single biggest reason people inquire about home solar is because their power bill is high. Home solar doesn’t reduce the consumption of power but the following chart suggests some things that do.

The purpose of an energy preparation plan is to make your home achieve maximum efficiency before buying a solar system. When you get your home to maximum efficiency you will need a smaller solar system that can save thousands of dollars.

| Air Conditioning | Sometimes New AC Units can cut power bills in half if they’re over 10 years old. You will get noticeable savings at a minimum which will pay for the new A/C in time. |

| Roof | Older roofs are not as efficient and it’s Ideal for the roof and solar panels to age simultaneously. |

| Windows and Doors | Caulking Is The Least Costly and Money Saving Thing To Do In A Home |

| LED Lighting | Amazing Energy Saving Technology! |

| Attic Fans and Blown Insulation | Go The Extra Mile for Additional Savings! |

| Ready for Solar | At This Point, Your Home Is Efficient Enough To Determine The Actual Monthly kWh Usage Which should Be Considerably Lower than before The Improvements Started. |

| Solar Equipment | This Is Where Some Expertise Goes A Long Way! |

| Installation | Expert Licensed and Insured Contractor |

| Get Top Quality Equipment of Less | Buy All of Your Equipment Wholesale and Save Big! |

| Use A Solar Consultant | Florida Solar Report Has Given Birth To A Revolutionary Idea About How To Cut The Cost of Solar Dramatically “Your Solar Advocate” Consultant Firm. |

The Better The Plan The More Savings

Any homeowner should execute an energy plan in order to achieve maximum profitability from home solar. At this point in 2020 it’s hard to imagine somebody actually losing money from home solar. Home solar is opportunity knocking because there really isn’t any downside if you buy right.

Awareness is the key and that’s the intent of Florida Solar Report. We provide readers with information to protect themselves from making a bad investment and have a profitable solar experience! Why Solar Now It’s a Guaranteed Investment.

Federal Tax Credit 26% In 2022 and 22% In 2023

These days the solar tax credit seems to be all they talk about on solar company blogs. The reason is simple and it’s because it’s a huge savings! No question about it it just makes going solar a no brainier.

The key here is to consult your tax prepare and be sure you qualify for it. It’s based on folks who pay actual income tax equal to or more than the actual tax credit. Read more here Federal Solar Tax Credit 2020: Step By Step Guide.

The Number One Myth About Solar?

It’s time to dispel the myth that solar is expensive because relatively speaking it’s a bargain. Just look at the above example of how much money you are going to pay the power company over the next 25 years, $49,500 (Based On a $150 power bill with increases included).

Lets say, you paid as much as $20,000 for a system that gives you a return of $49,500 relatively speaking that’s a great return.

Relative to a $40,000 car a $20,000 solar system is a bargain. You are spending that $49,500 without solar because you will pay your power bill. “Why Solar Now It’s a Guaranteed Investment!