Federal Solar Tax Credit 2021 thru 2024 Step By Step Guide

Great News The 26% Savings From The Federal ITC Tax Credit Has Been Extended Through 2022!

Federal Solar Tax Credit Guide 2021 Thru 2023 explains exactly how the Federal Solar Renewable Energy Tax Credit Works? More importantly, learn if it will work for you?

Any tax credit earned when installing solar ( The Investment Tax Credit ) (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes for a purchase of solar in 2021. The ITC applies to both residential and commercial systems, and there is no cap on its value.

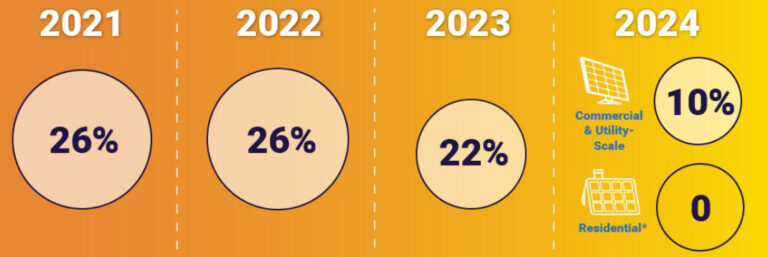

*The ITC is 26% for 2021 through the end of 2022 then goes to 22% in 2023 and then the home solar Federal Tax Credit ends January 1st, 2024

Federal Solar Tax Credit Guide 2021 Thru 2023

The Federal Tax Credit Is Quite Substantial

The Following Is An Example Only! – It’s Imperative To Consult A Tax Expert!

The investment tax credit for solar systems in Florida is 26%. If your system cost is $20,000 your tax credit is $5200. The net cost of your system is $14,800. How do you actually receive that $5200 is the real question?

Here’s how the Federal tax credit works, you deduct the tax credit from your actual taxes owed or pre-paid. So if you owe or have pre-paid $5200 in taxes for the year 2020 and your tax credit is $5200, you owe nothing in taxes. If you pre-pay your taxes then you will get a $5200 refund.

Now if your taxes were $2,100 and your tax credit is $5200 you can carry forward the difference for up to five years. Although you saved $2100 in 2020 you can still deduct the tax credit the next year. You can use the tax credit until you have reached $5,200 but you have only five years to exhaust it. After 5 years if there are any unused claims for any part of the tax credit it’s UN-claimable.

Cash Is King When Buying Home Solar

You’re better off paying cash and purchasing your system during a high earnings year because you can use your entire tax credit and save financing interest. In a high earnings year, you can buy your Solar System for cash and possibly realize as big a savings if not bigger than the tax credit. Because when you pay cash, the savings on Interest is quite substantial and the closing points for the loan could be $2500 or more.

The truth is if you can afford to pay cash, going solar is a no-brainer, because you’re saving money every month. Your saving money every month for the next twenty-five years or longer. This doesn’t mean a financed system is not a good investment. If you buy right, even financed solar systems offer huge savings because you’re paying the power company every month.

Be Cautious With Solar Companies

When a solar company is presenting you a solar proposal quite often they’ll include your tax credit in the deal. This is important to know because they can’t control when or how you receive your tax credit. They also can not control what you do with your tax credit or if you qualify for it. Should your tax credit be included in your deal it is then expected for the buyer to pay that tax credit to the finance company. The trick they use to disguise what they’re up to is your loan is interest-free for the first 15 months. Then all of sudden because you didn’t pay that tax credit money toward the solar system the payments go up.

Most Purchases of Solar Financed Receive 2 Different Payment Amounts From Solar Companies

Many solar companies include the tax credit in your deal with the expectation you pay it to the finance company when you receive it. Most financed deals give you interest-free for the first year. The reason is you don’t receive a tax credit for up to a year from the time of purchase. So the finance company wants to give you ample time to include your tax credit into the deal to lower your payments.

Basically, the solar companies use your tax credit as a down-payment for your purchase. The problem here is many people misunderstand, they don’t actually get a check from IRS but an offset of taxes owed. so they end up with a higher solar system payment than their power bill was because they didn’t pay the tax credit to the finance company. Our recommendation is, do not include your tax credit in your home solar deal. The tax credit should be between you and your tax expert.

If you don’t pay the tax credit money to the lender your system becomes a 100% financed system because there’s no down-payment. Basically, many of the solar companies use your tax credit as a down-payment for your purchase but probably sold you on no money out of pocket!. It’s a slick way to make people believe their payment is lower than it is.

THE FOLLOWING IS AN ACTUAL SOLAR PROPOSAL IN 2018

The Only Place That Shows You The True Payment Amount Without The Tax Credit Is On “The Finance Contract”! Only One Payment Amount In This Actual Customer Proposal! The first 15 months are interest-free so the payment is lower but not relevant to the point I’m making.

Notice They Included The Tax Credit In The Deal!

25 Year Warranty LOL, They Are Out of Business since August 2019! Do You Believe Solar Panels Will Last?

The biggest challenge is that most folks don’t believe that solar panels will last for twenty-five years or more? The truth is they are designed to last for forty years or more and are storm tested. Most brands of solar panels have a 25-year manufacturer warranty.

The best clue you have for how long solar panels last is the power companies are using the same panels. They wouldn’t be making such a sizable investment into solar farms if the technology wasn’t sound. Also, the specialty finance companies wouldn’t do 20-year financing if the equipment didn’t last that long.

So if a solar payment is at or below your power bill there really is no reason not to go solar. But if you buy your equipment wholesale the cost of solar is substantially less and you can make a profit.

At a minimum, you’re helping the environment with no additional expense by off-setting power bills. Buy right and you will more than likely realize substantial savings by going solar.

How Do I Apply for And Receive My Solar Tax Credit?

Include The Tax Credit In Your Tax Filings

Federal Solar Tax Credit Guide 2021 Thru 2023 explains how you receive the tax credit for those who do qualify. Include IRS Form 5695 when you file your taxes. Here is the link for Tax Credit Instructions.

Also, use Form 5695 to take any residential energy efficient property credit carry forward from 2018. Or to carry the unused portion of the credit to the year of purchase (2021 thru 2024). You may be able to take the credits if you made energy-saving improvements to your home located in the United States in 2019. Always Consult a Tax Expert to know if you personally qualify for the ITC (investment tax credit)!

Hello, I’m Ron Hunnewell, Owner and founder of Your Solar Advocate

I have created Your Solar Advocate to connect you with the industry’s very best Home Solar Installers.  You have many choices and may not be certain whom to work with? As Your Solar Advocate representing your interests, “I Cut Out The Middle Man” and set you up directly with the very best in the business! The best quality solar panels, Installation all for the lowest cost!

You have many choices and may not be certain whom to work with? As Your Solar Advocate representing your interests, “I Cut Out The Middle Man” and set you up directly with the very best in the business! The best quality solar panels, Installation all for the lowest cost!

Get The Best Solar Contractors!

Get The Lowest Price In The Market!

Make The Most Profit From Home Solar!

Many national brand solar companies never actually touch or see the solar panels. They make the sale using online blogs and other sales funnel methods. The key is they hire a general contractor who does many different types of construction, and the GC farms it out to an installer. Far too many hands are in the pot causing the cost to go up considerably.

What I have created is an opportunity for the solar buyer to deal directly with that same solar installer instead of sales funnels, and inexperienced GC’s charging inflated prices. I am Your Solar advocate who will guide and direct toward the best equipment and licensed and insured installation contractors in your market.

I connect you with directly with Solar Installation Contractors that exclusively do solar. You get the jobber price as if your a national brand solar company. When you decide to move forward you will deal directly with the installer who is licensed and insured with a minimum of 500 installations of home solar.